Technologies that Solve Trust Problems

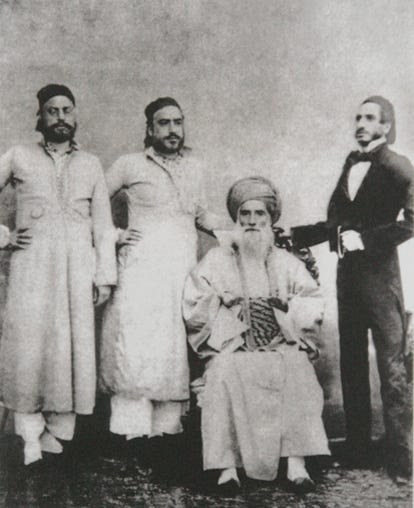

There was a time when a single family of Baghdadi Jews — the Sassoons — played a pivotal role in facilitating global trade. With family members spread across cities around the world, the Sassoons created a layer of trust that greased the wheels of trade. If you were a merchant in Baghdad who wanted to sell to a buyer in Shanghai, you didn’t need to trust the buyer in Shanghai. You trusted the Sassoons in Baghdad, who trusted the Sassoons in Shanghai, who knew whether the buyer in Shanghai was good for the money.

When I was first introduced to the story of the Sassoon family, I was struck by the fact that the architecture of global trade is still essentially the same today — with multinational banks playing the role that was once occupied by a single, albeit far-flung family. Why is this the case, when technology has transformed virtually every other aspect of our economic system? This is the question that ultimately led me to co-found Panjiva. Panjiva brings massive amounts of data to the table, giving participants in global trade a new tool to identify which companies can be trusted.

My experience leading Panjiva only underscored for me how much value can be unlocked when trust is established — and just how hard it is to establish trust. This is why Chris Dixon caught my attention when he described blockchains as “computers that can make commitments.”

The casual observer of blockchains knows about Bitcoin or, more recently, NFTs. But these are specific applications of crypto technology which, more generally, is a technology that solves problems in and around trust.

How do you build a digital currency that is protected against inflation? Well, among other things, you need to credibly commit to not mint more of this currency when it suits you. Who could possibly make a commitment that would be trusted? By now we know that no individual, business, or even government could credibly commit to this. But, under the right circumstances, computers can.

Computers that can make commitments have led to the creation of digital currencies, digital art, and even digital horse racing. Depending on who you ask, we’re in the Cambrian phase or the Ponzi phase of the crypto era — maybe both. But I, along with others, keep returning to the question of whether the world’s most dynamic technology platform can play a role in solving the world’s most pressing post-COVID challenge — climate change.

To be fair, more people are currently focused on the possibility that crypto will make climate change worse, through its consumption of huge amounts of carbon-intensive energy. Crypto’s defenders (fairly) point out there are far more damaging economic activities than crypto, and the trend is toward less energy-intensive crypto techniques. Some go further and argue that crypto, as a growing consumer of cost-advantaged renewables, will lead to increased investment in renewable energy. This feels like a reach, but also misses the more significant ways that crypto can play a constructive role on climate.

Most obviously, crypto is a technology that solves trust problems, and trust problems abound in the climate space. Take carbon credits, for example. Companies that can’t totally eliminate their emissions often want to buy offsets, paying others to capture carbon or reduce emissions. How can you trust that the organization removing carbon isn’t selling this offset to multiple buyers? You either need a trusted clearinghouse or a secure, distributed ledger.

Can the crypto community and climate community work together to tackle urgent trust problems? At first glance, you might expect these communities’ cultures to clash. Many in the crypto community lean libertarian, while many in the climate community are clamoring for government intervention.

There are, however, some interesting similarities. As I have learned first-hand, both of these communities are skeptical of newcomers. More importantly, both communities believe that humanity’s traditional ways of doing things — whether it’s how we transact or how we consume — are outdated. Relatedly, both communities are deeply committed to reshaping the world, albeit in orthogonal ways. Interestingly, the number of crypto projects with a climate angle is growing. But it still feels like we’re just scratching the surface of what’s possible. More on this to come.

Since leaving S&P Global, which acquired Panjiva, I’ve been obsessed with these two worlds: climate and crypto. If you’re interested in either, or both, or just want to follow my adventures, subscribe to this (free) substack.

Next up… A sampling of existing projects at the intersection of climate and crypto. But, first, meet the Sassoons:

B"H" A nice article about the Sassoon history by means of a review Kings of Shanghai book https://www.hadassahmagazine.org/2020/11/17/last-kings-shanghai-review/

Here is also the Hong Kong family tree https://jhshk.org/community/the-sassoon-family-tree/

Great post! Can’t wait to see more!